Defi staking is one of the hottest trends in Cryptocurrency because of its high profit. Although it is a simple concept, it offers a variety of benefits and rewards as high as 13% of their holdings that attract millions of users. If you’re into cryptocurrency or have heard of DeFi, then you might be aware of DeFi staking. If not, we are here to introduce you to it.

DeFi stands for decentralized finance, unlike CeFi, referred to as centralized finance. DeFi provides users with multiple decentralized finance end-to-end services through smart contracts on a blockchain. Without a doubt, DeFi plays a significant role in disrupting blockchain technology. As the financial world is taking a 180-degree turn whose credit goes to DeFi to a certain extent, this new form of the financial system is outperforming security and efficiency.

Today, in this article, we will be explaining the concept of defi staking, what it is, and how you can earn through it. So, if you’re someone interested in cryptocurrency or bitcoin, make sure you read this article till the end. Without any further ado, let’s get started!

What is DeFi Staking?

DeFi staking can be described as the process of locking your crypto assets in the smart contract. In the past few years, cryptocurrencies have gained immense popularity, and the concept of crypto staking has been sticking around for quite a time now. In simple terms, it is a powerful yet simple way to hold onto crypto holdings. As mentioned earlier, in contrast, the concerned users will get staking rewards as high as 13% of their holdings. Hence, it can be concluded that the staking rewards are way better.

To some people, the DeFi staking may not appear exciting; however, it is a less risky and safer way to generate passive revenues while worrying less about other concerns such as lack of transparency, corruption, hidden fees, and so on.

Above all, the users can easily access higher revenues which isn’t the case when choosing the traditional avenue. With little to no intermediaries, the profit increases at a higher rate. Most importantly, the customers have higher control over their funds.

Recently, it has been noticed that more and more DeFi protocols and platforms are driving their focus towards DeFi staking, making it a bigger deal than it was when introduced. The most common example of DeFi staking is the DApp that allows users to earn money against their cryptos. Synthetix is another popular platform for engaging in DeFi.

Types of DeFi Staking

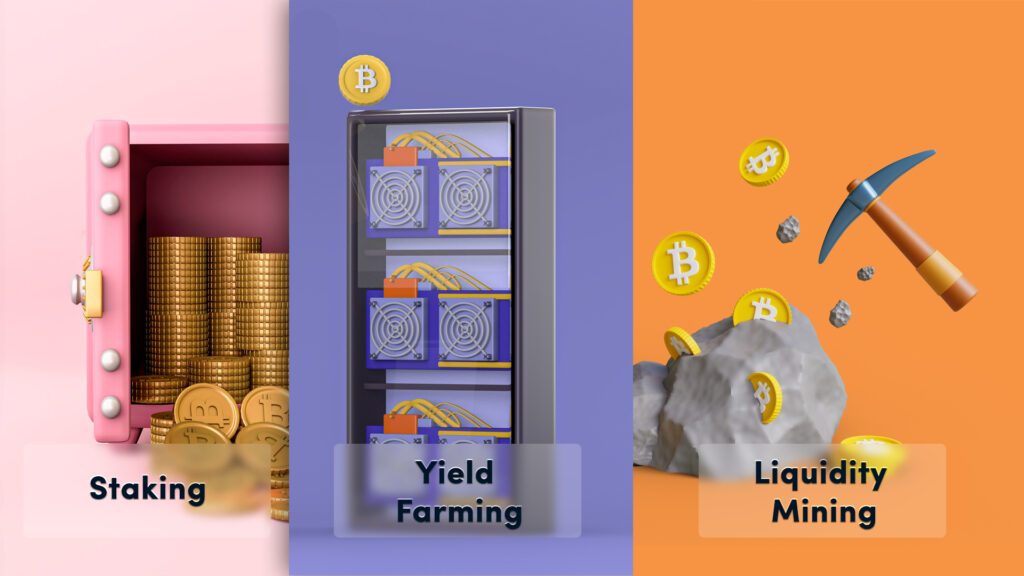

There are mainly three major types of DeFi staking. These include:

- Staking – The staking is locking a certain amount of crypto assets such as NFTs to come up as a validator in a Proof-of-Stake or the PoS blockchain network.

- Yield farming – Yield farming is a process where different crypto assets are moved between multiple Defi staking platforms with the aim of profit maximization.

- Liquidity mining – Liquidity mining comes under yield farming which includes offering crypto assets to the liquidity pool.

Earning Through Staking

As mentioned earlier, DeFi staking is described as a process of locking crypto tokens into the DeFi smart contract for earning more such tokens in return. Every time a user locks or stakes their crypto assets in the DeFi system, they become an integral part of the validators for the network. To ensure the protocols’ security, each proof-of-stake blockchain protocol is highly dependent on these protocols. As a result, ensuring that none can cheat the system relies on these validators. Also, people who have decided to lock their tokens for securing the network will be rewarded for all actions.

While the DeFi technology seems promising, several points need to be kept in mind, at least for now. Marwan Forzley, the CEO of Veem, explains that just like other cryptocurrencies, the tech is still in its infancy. Decentralized finance or DeFi is still in its first stage, and there’s a long way to go. Though the results it may show are substantial, it is vital to understand that most DeFi coins do not carry liquidity which is a significant drawback in the digital market.

The DiFi infrastructure is still full of mishaps that are opening the backdoors for scams. Although tricks and tips are used to cover the gaps, multiple questions still need to be worked upon for DeFi to become a sustainable choice by the masses. While DeFi and Blockchain technology is building fast around the world, Cryptocurrency in India is nowhere less.

The Bottom Line

For many years, DeFi staking has been gaining immense popularity globally. As a result, more protocols and platforms provide this functionality to healthy innovation and competition. Some providers go for cross-chain support, whereas others focus on reward schemes. However, both the concepts are equally viable. With better support and reward, it’s an excellent way to earn profit through staking.

BuyUcoin is one of India’s most secure crypto exchanges, where we provide a wide range of products and services to easily sell, trade, buy, and store cryptocurrency in India. If you’re looking to start crypto trading, join BuyUcoin now.